Tax Rules

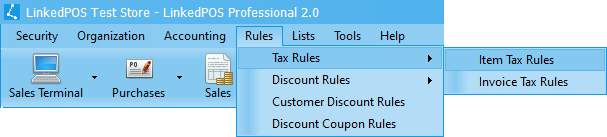

In different countries/states/provinces/areas, Tax Rules exist with different names and ratio/amount (percentage or fixed) also vary. LinkedPOS facililtates the creation of flexible Tax Rules as per regulations issued by the concerned regulatory authority. Go to main menu, click on the dropdown menu Rules, hover the mouse over Tax Rules and then click on the Item Tax Rules or Invoice Tax Rules.

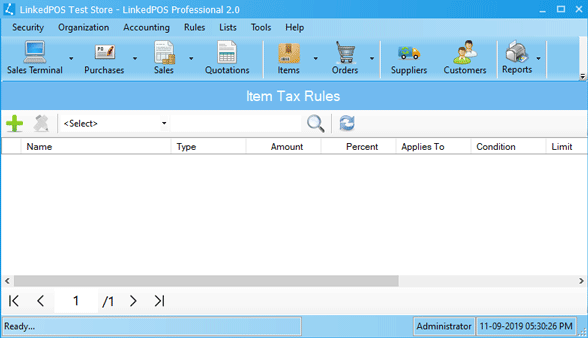

Item Tax Rules

This option becomes handy when Tax is applicable to selected items only. This option allows the creation of Tax Rules on individual items. Go to main menu and click on the Rules dropdown menu, hover the mouse over Tax Rules and then click on Item Tax Rules. The Item Tax Rules table will appear as shown in the image below:-

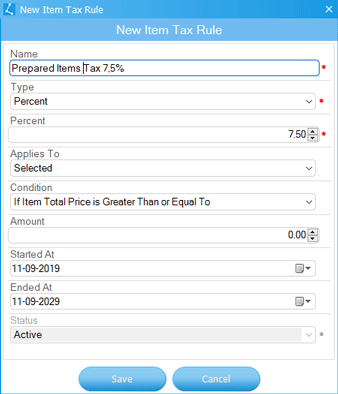

Adding New Item Tax Rule

On the toolbar of the Item Tax Rules table, press the

button

and a dialog will appear as shown in the image below.

button

and a dialog will appear as shown in the image below.

Type the Name of the Rule and select the Type from the dropdown list containing options as shown in the image below:-

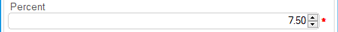

Next step is to enter the value for Percentage or Fixed as shown in the image below:-

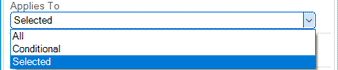

Next step is to select the entity to which the tax will be applied from the dropdown list containing options as shown in the image below:-

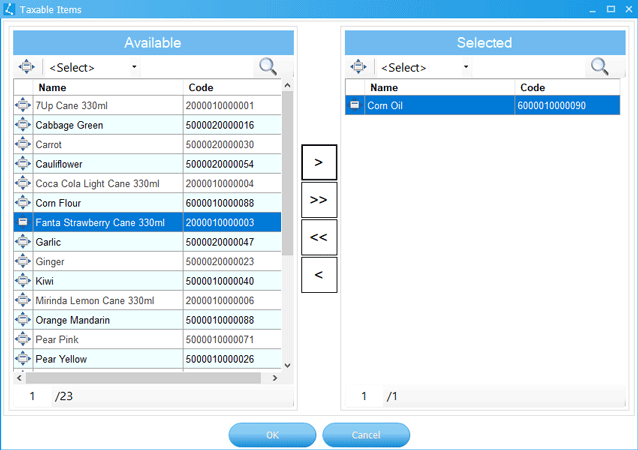

If the selected option in the previous step is Selected, then a dailog will appear as shown

in the image below. Click on the item in the list of items on left hand side and then

press the  button. The tax will be applied on the items moved to the right side. If the item is required to

be removed from tax list, then click on the item in the list of item on right side and press

the

button. The tax will be applied on the items moved to the right side. If the item is required to

be removed from tax list, then click on the item in the list of item on right side and press

the  button.

When the list is finalized, then press the

button.

When the list is finalized, then press the  button.

button.

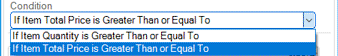

Next step is to select the condition from the dropdown list containing options as shown in the image below:-

Next step is to enter the value relevant to the selected condition. If the value is left as zero, then the rule will always be applied.

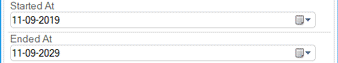

Next step is to select the tax starting date and expiry date.

When all relevant values have been entered or selected then press the

button

to save the rule.

button

to save the rule.

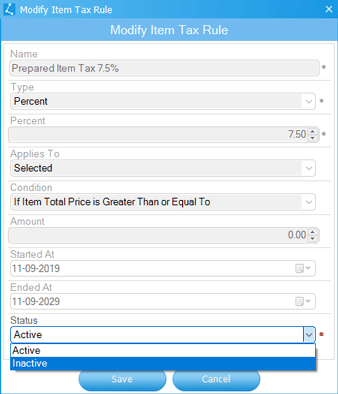

Modifying Existing Item Tax Rule

Double click the Item Tax Rule or click on the Rule in Item Tax Rules table and then press the

button on the toolbar of Item Tax Rules table. A dialog will appear as shown in the image below.

button on the toolbar of Item Tax Rules table. A dialog will appear as shown in the image below.

button.

The only option is to mark an Item Tax Rule as Inactive.

If any change in values is reuquired, then mark the rule as Inactive and create a new

Item Tax Rule.

button.

The only option is to mark an Item Tax Rule as Inactive.

If any change in values is reuquired, then mark the rule as Inactive and create a new

Item Tax Rule.

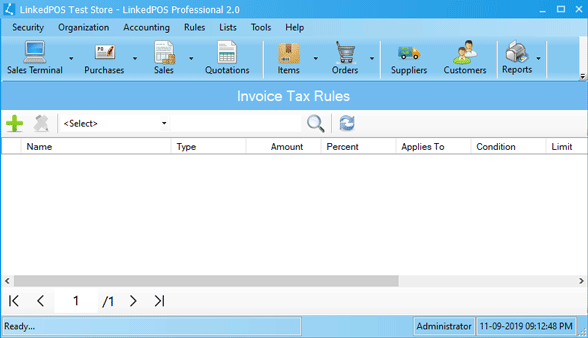

Invoice Tax Rules

This option becomes handy when Tax is applicable to an invoice as a whole. Go to main menu and click on the Rules dropdown menu, hover the mouse over Tax Rules and then click on Invoice Tax Rules. The Invoice Tax Rules table will appear as shown in the image below:-

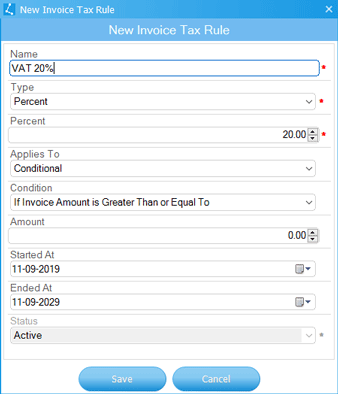

Adding New Invoice Tax Rule

On toolbar of Invoice Tax Rules table, press the

button

and the dialog will appear as shown in the image below.

button

and the dialog will appear as shown in the image below.

Type in the Name of the Rule and select the Type from the dropdown list containing options as shown in the image below:-

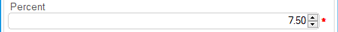

Next step is to enter value for the Percentage or Fixed as shown in the image below:-

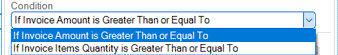

Next step is to select the condition from the dropdown list containing options as shown in the image below:-

Next step is to enter the value relevant to the selected condition. If the value is left as zero, then the rule will always be applied.

Next step is to select the tax starting and expiry date.

When all relevant values have been entered or selected, then press the

button

to save the rule.

button

to save the rule.

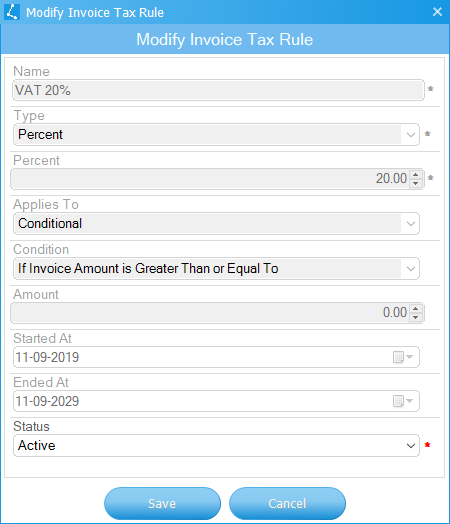

Modifying Existing Invoice Tax Rule

Double click the Invoice Tax Rule or click on the Rule in the Invoice Tax Rules table and then press the

button on toolbar of the Invoice Tax Rules table. A dialog will appear as shown in the image below.

button on toolbar of the Invoice Tax Rules table. A dialog will appear as shown in the image below.

button.

The only option is to mark an Invoice Tax Rule as Inactive.

If any change in values is reuquired, then mark the rule as Inactive and create a new

Invoice Tax Rule.

button.

The only option is to mark an Invoice Tax Rule as Inactive.

If any change in values is reuquired, then mark the rule as Inactive and create a new

Invoice Tax Rule.